Мы на выставке интегрированных систем ISE 2025

Как Ülkü Kablo и Feby Cable, мы будем участвовать в выставке интегрированных систем ISE 2025.

Все наши группы продуктов производятся в соответствии с международными стандартами с использованием превосходного качества и передовых технологий.

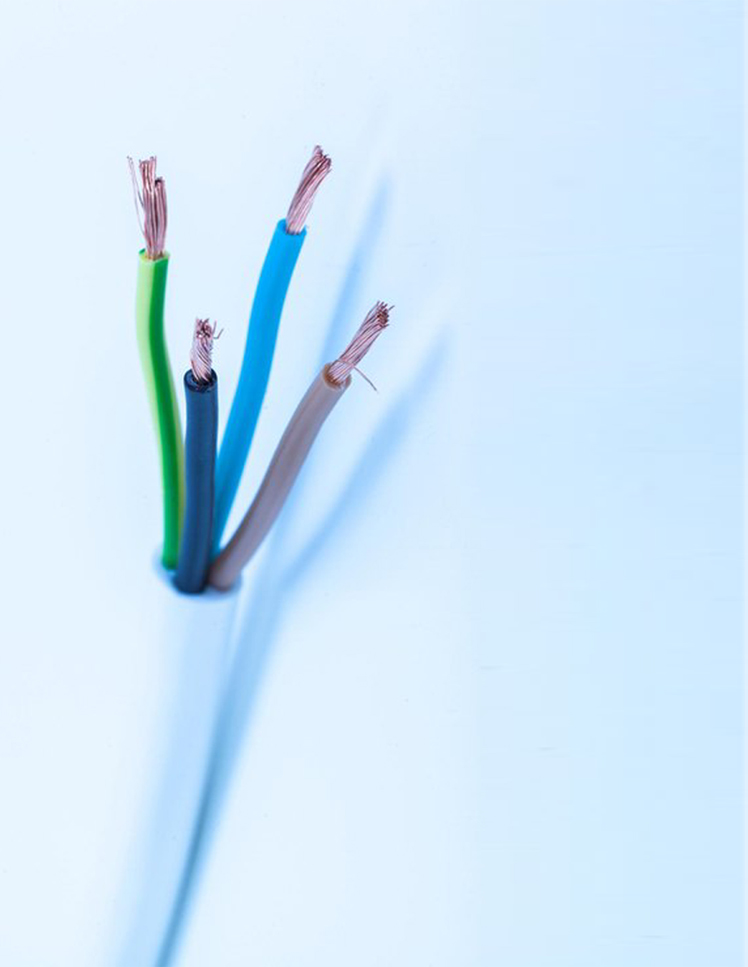

Наша компания, которая начала свою деятельность в кабельной промышленности в 1985 году, непрерывно продолжала свою деятельность во многих областях от автомобильной промышленности до электротехнической и электронной промышленности в производстве кабелей.

Наша компания, которая развивает свою производственную структуру как аудиокабели, детонационные кабели, кабели для автомобильной промышленности, плоские кабели, монтажные кабели, сигнальные и контрольные кабели, расширяет ассортимент своей продукции в соответствии с отраслевыми требованиями.

Наша компания, которая продолжает свою деятельность в соответствии со своими целями, стала предпочтительным учреждением со своими постоянно обновляемыми технологиями и современным подходом к производству, не отступая от своих принципов, и с открытой для изменений и перспективой развития.

Мы делаем все возможное, чтобы помочь нашим поставщикам и клиентам создавать различные ценности и решения для своей жизни, выступая в качестве настоящего делового партнера. Продолжение нашего успеха возможно с ростом наших деловых партнеров. Мы ориентированы на клиента для роста нашего бизнеса и работаем над экономическими решениями с инновационной и инвестиционной структурой, не делая уступок в отношении качества продукции и услуг, придерживаясь этических ценностей. Мы осознаем важность конфиденциальности клиентов. Мы ставим во главу угла надежность и работаем, не оставляя никаких подозрений в вашем сознании.

Обеспечивается постоянная и быстрая система управления клиентами с посещениями клиентов.

Большинство документов, доставляемых заказчику, создаются безошибочно и в кратчайшие сроки благодаря ERP-системе.

Наша продукция одобрена документами TSE, ISO 9001:2015. Следовательно, все возможные проблемы, которые могут возникнуть с продуктами, решаются сразу после их обнаружения. Продукция Ülkü Kablo продолжает безопасно использоваться во всем мире.

В случае возникновения проблем в процессе производства, производство повторяется, а бракованный продукт не отправляется заказчику.

Все учитывается до мельчайших деталей в процессе доставки согласно согласованным с заказчиком условиям поставки.

Вы можете связаться с нами, заполнив форму, чтобы получить подробную информацию о нашей продукции.

Вы можете связаться с нашим проектным отделом по всем вашим специальным запросам на продукцию.

Вы можете связаться с нашим отделом продаж для получения наших рекомендаций и принципов работы.

Вы можете связаться с нашей линией Whatsapp для онлайн-встреч.

Как Ülkü Kablo и Feby Cable, мы будем участвовать в выставке интегрированных систем ISE 2025.

Мы приняли участие в выставке интегрированных систем IMKB 2024 Europe как Ülkü Kablo и Feby Cable,

Индустрия кабелей и изолированных проводников Турции входит в число 10 крупнейших производителей в мире.